Like many European Union countries, Sweden is at a crossroads with its relationship with gambling, and online gambling in particular. CasinoOnline.se did research on what regulated online gambling can bring our country.

Along with many of its fellow EU members, it find itself under increasing pressure both from the gambling industry and the European Commission alike to abolish its long-standing monopoly and open up its market to competition from private-sector operators.

Along with many of its fellow EU members, it find itself under increasing pressure both from the gambling industry and the European Commission alike to abolish its long-standing monopoly and open up its market to competition from private-sector operators.

Historically, Sweden’s governments have resisted these calls for reform. But of late, more of its political parties are coming around to the idea. And with parties such as the Christian Democratic Party – a party that has staunchly supported Svenska Spel’s monopoly previously – now changing to a more pro-regulation stance ,Sweden could be on the brink of a change.

Why Sweden should open up its gambling market

In the case of most other countries, the benefits of online gambling regulation – such as expanded consumer choice, and increased tax revenue – are theoretical, and may take years to materialize.

But Sweden’s unique position means that not only are there potential benefits to be gained, it would help safeguard things such as its thriving private online gambling industry.

Regulation of Sweden’s online gambling market would offer the following benefits:

- Generate potential tax revenue of SEK 1.68 billion per year by 2016.

- Bring Sweden’s online gambling market in-line with European law, avoiding potentially costly fines in the process.

- Offer online-savvy Swedish consumers more choice.

- Allowing other industries to benefit (such as the media through advertising).

- Enabling Sweden’s private-sector gambling operators to go about their trade openly in their home country, instead of looking abroad.

- Free up current monopoly holder Svenska Spel to compete with currently unlicensed rivals with better products on a level playing field.

At loggerheads with Europe

At present, Sweden’s gambling market, including its online gambling market, operates under monopolistic conditions.

This has already drawn sharp criticism from the European Commission in recent years. In 2006, Sweden was one of a number of European countries to receive a formal request from the EC for information on its gambling laws. In June 2007, it then received a formal request from the commission requesting that those laws be amended to bring them in line with European Union competition laws (source: Niall O’Connor (2011) ”Sweden’s gambling industry and the long road to liberalisation” (Bettingmarket.Com)).

Aiding the current monopoly holder

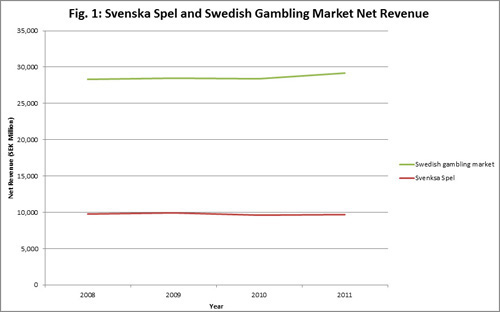

Ironically, the abolition of its monopoly could also help Sweden’s only current major licensed operator, the state-backed Svenska Spel, as well. Svenska Spel has been struggling in recent times:

- In 2009 and 2010, the company endured net falls in revenue.

- In 2011, it did see a rise in net revenue, but this was only sufficient to restore it to 2007 levels.

- During that time, it was estimated that the Swedish gambling market grew by around 1 billion SEK (source: GamingIntelligence.com).

- Despite its monopoly, In 2010 Svenska Spel estimated that foreign (unlicensed) operators accounted for 10% of the Swedish gambling market. (source: Gambling Compliance)

Svenska Spel’s CEO Lennart Kӓll has blamed this on competition from unlicensed operators, who aren’t hamstrung by the license terms that apply to Svenska Spel. Allowing its rivals to purchase licenses would help to level the playing field for Svenska Spel, potentially freeing it up to launch rival products of its own.

Why re-regulation is good for Swedes

The opening up of Sweden’s online gambling market to competition would offer both the country and consumers several distinct advantages.

One of these is the choice it would give Swedish gamblers, many of whom have embraced gambling – and online gambling especially – in a way their counterparts in other European Union countries have yet to:

- Despite having a population of only 9 million, Sweden had the fifth largest online gambling market in the EU in 2008 (source: Regulating Online Gambling in the EU).

- In 2009, 25% of total gambling losses in Sweden were incurred online (source: KPMG: Online Gaming).

- The average Swede spends 2.5% of their disposable income on gaming and lotteries (source: Sweden’s Digital Growth Industry).

(Source: KPMG: Online Gaming)

Much of this is due to Sweden’s proactive attitude towards the internet, resulting in the population being one of the most online in Europe. In 2010. 92.5% of the Swedish population had online access (source: Internet World Stats), with 40% having a broadband connection (Source: MVF Global). Sweden has also been at the forefront of mobile internet, being one of the first European countries to trial 4G connections.

Promoting economic growth

Another compelling reason for the re-regulation of the Swedish gambling market is the benefits it would bring to the Swedish online gambling industry.

Unlike many countries contemplating similar moves, Sweden is in the enviable position of already having a thriving online gambling industry (source: Sweden’s Digital Growth Industry):

- In total, there are nine publically listed Swedish companies operating in the online gambling market.

- These include operators Unibet and Betsson, and software companies Boss Media, Ongame and Net Entertainment.

- Their combined stock value is 11.3 billion SEK.

- There are further, unlisted companies operating in this sector.

Many of its leading companies may lack domestic licenses, but online gambling is one of Sweden’s most successful new exports, and a key growth industry alongside other high-tech industries such as videogames:

| Industry | Swedish Employees | Value |

|---|---|---|

| Online gambling | 3,400 (2011) | 11.3 billion SEK |

| Videogames | 1,102 (2010) | 322 million SEK |

Fig. 3: Comparison of Swedish Online Gambling and Videogame Industries (Source: Sweden’s Digital Growth Industry)

Allowing these companies to be licensed in Sweden could potentially see future jobs remain in Sweden (instead of being located in gambling havens such as Malta or Gibraltar), and would also make it easier to support the industry with tax breaks, cheap loans and other forms of direct and indirect investment.

Other Advantages

Proper licensing online gambling could potentially benefit other industries as well. Advertising of gambling products in Sweden has been a hotly contested subject, resulting in legal action against publications and members of the media for running adverts featuring ads from unlicensed operators (source: Bettingmarket.com).

Effective licensing would solve this issue. And if the examples of other countries are anything to go by, this would not only create new advertising revenue streams for magazines, newspapers, websites and television, but could potentially open up sponsorship opportunities for sports as well.

Direct revenue: Denmark, a shining example

Precisely how much Sweden stands to gain from regulating its market depends on the tax and license rates set, but neighboring Denmark could well serve as a useful comparison.

At the request of the European Commission, Denmark officially opened its gambling market up to competition on January 1, 2012. Prior to this, the Danish gambling market had been a monopoly, dominated by Dankse Spil.

Under the new terms however, private owners both from within and outside of Denmark could apply for licenses, under the following terms (source: Lesadv.dk):

- Licenses are issued annually.

- License costs range from DKK 50,000 (SEK 61,400) to DKK 1.5 million (SEK 1.84m), depending on gross profit.

- There is an application fee of DKK 250,000 (SEK 307,000) to provide betting or online casinos, or DKK 350,000 (SEK 430,000) to provide both.

- Operators are taxed at 20% of gross gaming revenue, in addition to the standard taxes.

Although barely six months have passed since the laws came into effect, the Danish Gambling Authority has still issued licenses to 38 different operators.

According to predictions from gambling operator Betsson, the Danish gambling market is due to almost double in the coming years, from its 2011 value of EUR 285 million to EUR 550 million by 2015.

In the case of Sweden, a similar rate of growth could certainly help deliver handsome revenues. In 2009, Svenska Spel valued the Swedish online gambling market at SEK 4.2 billion.

Using Denmark as an example, the following conclusions can be drawn:

- Within four years, Sweden’s online gambling market would likely be worth SEK 8.4 billion (or possibly more).

- This would be worth SEK 1.68 billion of direct gambling tax annually.

- Within the first six months of regulation, Sweden could receive as much as SEK 86.23 million in licensing fees.

The time is right

As the success of regulated online gambling markets in other European countries proves, the opening up of a country’s online gambling market can bring with it a lot of positive benefits.

In Sweden’s case, abolishing the current monopoly would improve both the choice offered to consumers, as well as enabling its current sole licensed operator the chance to compete on an even level.

But it would also bring in additional valuable revenue through tax and licensing, bolster its own thriving online gambling industry, and bring Sweden’s laws into line with those of the European Union. As such, Sweden’s political parties should now embrace online gambling regulation.